Image Generated Using 4o

What Is Happening?

The semiconductor industry has always grappled grappling with a persistent and intensifying equipment shortage. What began as a supply chain issue has now become a long-term structural constraint.

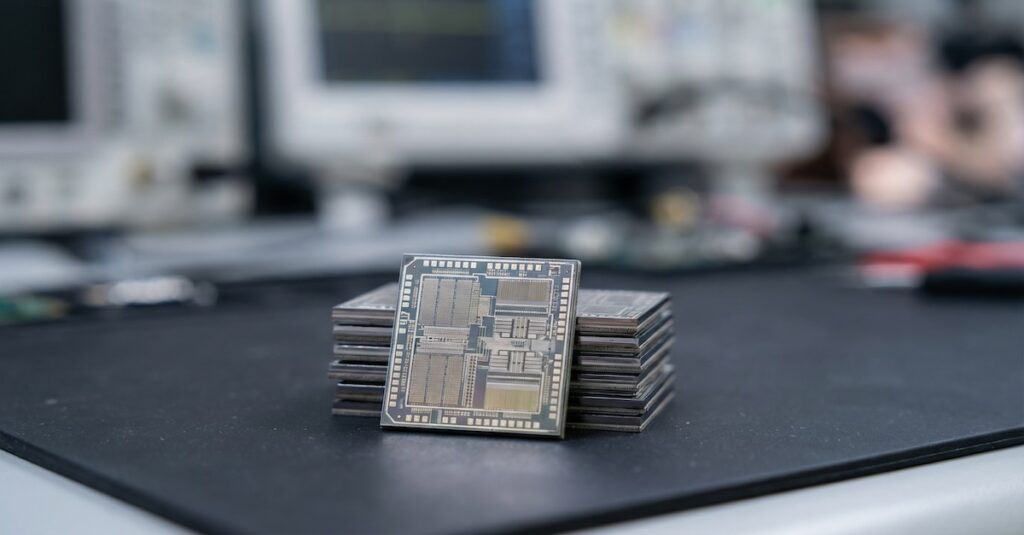

Lead times for advanced manufacturing tools, particularly those essential for next-generation process nodes, have extended to 12 to 18 months or more. At the same time, even equipment supporting mature technologies, such as 200 mm wafer processing, is experiencing delays.

This highlights the broad and systemic nature of the problem.

Why Equipment Shortage Becomes A Big Deal?

Semiconductor manufacturing is deeply dependent on a highly specialized class of equipment. Unlike general-purpose tools, these machines are purpose-built, node-specific, and often come from a limited number of suppliers.

When lead times stretch or tool availability drops, it directly impacts the ability of fabs to maintain their roadmap, yield, quality, and, ultimately, time-to-market. In short, the flow of innovation slows down not due to a lack of design capability but due to the absence of critical hardware.

Furthermore, the complexity of modern fabs exacerbates this challenge. A high-volume production line for advanced nodes may require more than hundreds of different tools across lithography, etch, deposition, metrology, CMP, and packaging.

These tools are not interchangeable and must be qualified together to maintain process integrity. When even one tool is delayed, it can stall an entire line, creating cascading effects across production schedules, R&D timelines, and customer commitments.

Let us take a look at the key reasons why equipment shortage disrupts semiconductor manufacturing:

| Aspect | Impact Due To Shortage |

|---|---|

| Tool Complexity | Advanced tools require long design and qualification cycles. Shortages cannot be solved quickly. |

| Limited Suppliers | Many equipment types are produced by only one or two vendors globally. |

| Node-Specific Dependency | Tools are tightly coupled with process nodes. Older tools cannot support new technology nodes. |

| Qualification Time | Tool installation is not enough, process tuning and validation take months. |

| Cascade Delays | Delay of one tool stalls entire production flow, affecting capacity and delivery. |

| Capital Inflexibility | Tool purchases involve long-term planning and capital allocation. Reacting fast is difficult. |

| Customer Commitments | OEMs cannot meet chip demand, leading to missed product launch windows. |

Eventually, with so much at stake, the absence of even a single critical tool can delay an entire roadmap, impacting everything from process migration to end-product delivery in data centers, smartphones, the automotive industry, and beyond.

How It Impacts Process To Product Roadmaps?

In the semiconductor industry, process development and product introduction are tightly interlinked. The process defines the physical capability. The product determines the commercial outcome. When equipment is delayed, both timelines are disrupted, affecting yield learning, PDK maturity, product qualification, and volume scalability.

A shortage of critical tools delays the start of process integration, slows down line bring-up, and reduces wafer availability for early silicon validation. This means that design teams working on cutting-edge products cannot access silicon when expected, pushing out verification cycles, delaying firmware and software stack development, and ultimately affecting go-to-market-to-market schedules.

| Roadmap Phase | Disruption Due to Equipment Shortage |

|---|---|

| Process Development (RnD) | Inability to start integration due to missing litho/metrology/etch tools. |

| PDK Release | Delays in baseline silicon characterization slow down PDK delivery to design teams. |

| First Silicon Availability | Fewer tools → fewer wafers → delays in prototype chips. |

| Design Verification And Debug | Lack of wafers hampers test chip data collection and corner validation. |

| Yield Learning | Limited data slows defect analysis, process tuning, and model refinement. |

| Ramp To Production | Line qualification cannot proceed on schedule, impacting customer commitments. |

| Customer Product Roadmaps | End customers delay their platform or system-level releases due to unavailable chips. |

From a strategic standpoint, roadmap slippage caused by tool shortages has become a defining bottleneck. In the past, product schedules were gated by design complexity or mask cycle time.

Today, it is common to see entire process families stalled at 90 or 95 percent readiness, waiting not on tape-out but on tool delivery, installation, and qualification. This shift redefines time-to-market planning across the industry.

What To Expect And How To Mitigate Equipment Cycle Time Impact?

The semiconductor industry should expect prolonged equipment lead times well into 2026, driven by persistent supply constraints, including a constant increase in demand for high-tech processes using advanced computing solutions for new-age workloads. Even with record levels of capital investment, manufacturing capacity at the equipment level cannot scale instantly.

This creates a new normal where tool delivery timelines must be considered a core constraint in both process development and product planning. The traditional assumption that capital expenditure translates directly into immediate equipment availability is no longer valid.

To mitigate this impact, companies should adopt a mix of strategic and operational responses. These include placing multi-year tool orders, pre-qualifying process steps across multiple sites, and using virtual process modeling to reduce dependency on physical wafers in early development.

Most critically, close alignment between fab teams and end customers will be essential, ensuring that roadmap changes driven by equipment constraints are communicated and absorbed early in the product planning cycle.